Rare earths are the backbone of many of the devices we use on a daily basis, as well as the technologies that are already contributing to the health of our planet.

An overview

Rare earth elements (REE) are an element group on the periodic table that most people have never heard of, despite their use in many common products used on a daily basis.

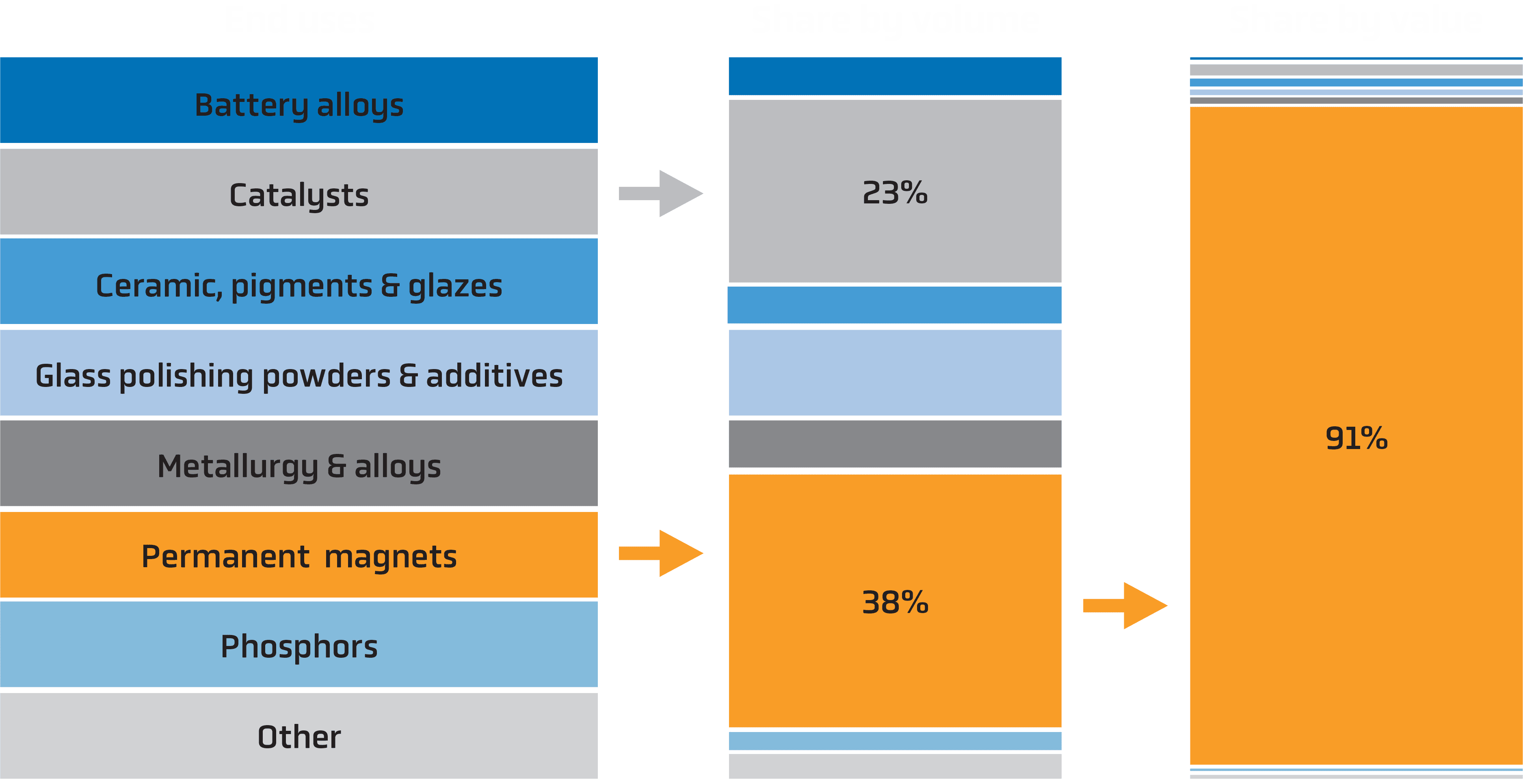

Constituting 30% of the market by volume and >90% by value, rare earth permanent magnets (REPMs) are so powerful they are the heart of modern efficient motors that drive electric vehicles, wind turbines and appliances, reducing power consumption and thereby reducing GHG emissions.

Rare earth elements have many other high tech applications, including in defence, medicine, aerospace, agriculture, catalyst and chemical industries. In Japan they are often referred to as the seeds of high technology.

Rare earth elements essential to the production of high-strength permanent magnets are in the highest demand.

Essential to the production of clean energy technology, the already substantial market for rare earth elements is growing rapidly. AR3 aims to separate and market the valuable clay-hosted rare earth elements discovered in South Australia and western Victoria to help secure a diverse and sustainable global supply of materials critical to our future.

Typically, REE are divided into Light and Heavy categories (LREE and HREE).

The name “rare earths” is slightly misleading, as many REEs are in fact relatively abundant in the Earth’s crust. What is unusual is to find deposits in significant concentrations to economically extract and process.

Exploration of the Koppamurra region has shown it contains significant quantities of LREEs Pr and Nd as well as the HREEs Tb and Dy.

Not only does demand for these four elements collectively make up the majority of global demand today; future demand is expected to grow faster than demand for all other rare earth elements, challenging the ability of the supply-side to keep up. Accordingly, currently our main focus is the production of these rare earths in a form that is readily marketable those end users seeking new independent long-term supplies that can be integrated into complex supply chains.

Praseodymium is a light rare earth elements that is used to produce high-strength permanent magnets and commonly referred to as neodymium iron boron (NdFeB) magnets.

The unique strength, light weight and reliability of these magnets are the key to their application in hybrids, electric vehicles and wind turbines.

Neodymium is a light rare earth elements that is used to produce high-strength permanent magnets and commonly referred to as neodymium iron boron (NdFeB) magnets.

The unique strength, light weight and reliability of these magnets are the key to their application in hybrids, electric vehicles and wind turbines.

What are they used for?

REEs are used in many applications but the highest value application is in the production of rare earth permanent magnets (REPMs), which are critical to the performance of many modern devices and clean energy technologies.

The importance of permanent magnets to the rare earths market is best highlighted by the dominance of end use value shown in the illustration below.

Neodymium iron boron (NdFeB) is the strongest permanent magnet commercially available (energy product/m3). This energy product density is crucial for weight-sensitive applications such as electric motors. NdFeB alloys also contain minor concentrations of Pr, Dy, Tb to optimise physical properties for specific applications.

Due to supply constrains in China and a lack of new production, Adamas Intelligence forecasts shortages of NdFeB as soon as 2023, with demand increasing from ~200,000tpa in 2021 to over 400,000tpa by 2030.

Large markets for REPMs include electric vehicles, wind turbine drives and household appliances.

Demand for Neodymium Iron Boron (NdFeB) permanent magnets, used in electric vehicles and wind turbines, will support prices for Praseodymium (Pr), Neodymium (Nd), Terbium (Tb), and Dysprosium (Dy) in which Koppamurra is well endowed.

Where are rare earths typically located and produced?

The rare earths market is dominated by China whether measured by either mining volume and/or downstream production capacity.

This is evident when focusing on the rare earths that are most relevant to AR3, primarily Neodymium (Nd), Praseodymium (Pm), Terbium (Tb) and Dysprosium (Dy).

While all REE markets are dominated by China, Neodymium and Praseodymium are mined from alternative global sources such as Australia and the USA. Terbium and Dysprosium are sourced almost entirely from ionic clays in China and Myanmar. The Chinese dominance is even greater when considering refined production volumes for Neodymium and Dysprosium. Almost all Dysprosium oxides are produced out of China, while only Malaysia and Estonia offer alternatives to the dominant Chinese Neodymium oxide production.

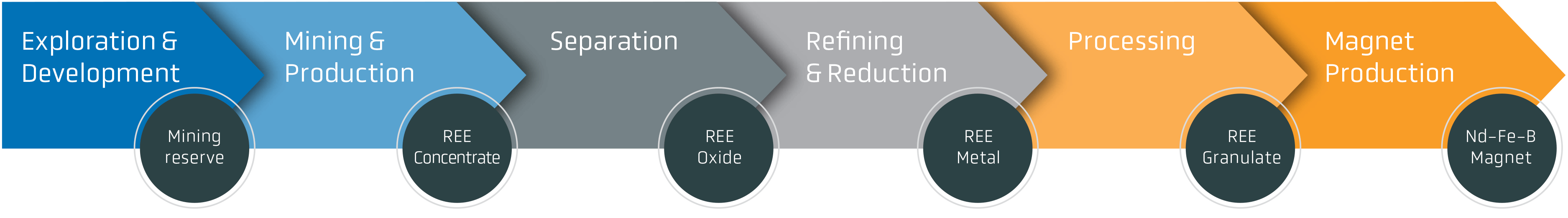

One by-product of the historic domination of the REPM market has been the lack of knowledge sharing surrounding the supply chain from mine to magnet. A simple representation of the process is shown below. Because of the dominance of China over this supply chain, process information after the production of REE Concentrates is not widely understood outside China. AR3 is actively investigating partnerships to co-develop an integrated supply chain that will not be reliant on the traditional processing channels.

AR3 Rare Earths

AR3 aims to separate and market the valuable clay-hosted rare earth elements discovered in South Australia and western Victoria to help secure a diverse and sustainable global supply of materials critical to our future.

Exploration of the Koppamurra region has shown it contains significant quantities of LREEs Pr and Nd as well as the HREEs Tb and Dy.

Not only does demand for these four elements collectively make up the majority of global demand today; future demand is expected to grow faster than demand for all other rare earth elements, challenging the ability of the supply-side to keep up. Accordingly, currently, our main focus is the production of these rare earths in a form that is readily marketable to those end-users seeking new independent long-term supplies that can be integrated into complex supply chains.

Today, China produces over 90% of the global demand for REPMs which is considered unhealthy, similar to OPEC’s domination of the oil industry. Due to China’s large rare earth resources and advanced manufacturing technologies the country is likely to remain at the forefront of the industry. In the interests of sustainability the major end-users, such as the automotive industry, are seeking more diversity of supply throughout their supply chains. AR3 aims to be a trusted participant in the new supply chains under consideration.